The Fundamentals Don't Matter Anymore

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

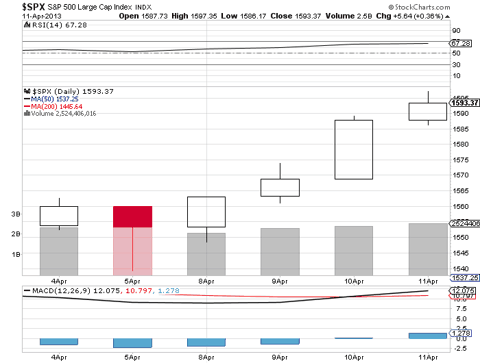

What a difference a week makes! Last Friday morning, on April 5, the Bureau of Labor Statistics (BLS) reported a horrible payroll employment number that was well below consensus expectations. The S&P 500 (SPY) tumbled more than 20 points at the opening bell in reaction to the news. That panic began to abate at approximately 9:35 am, within five minutes of trading, when the low for the day was established at 1539.50. Five minutes of investor disdain for the single most important piece of economic data that is reported each month, and then it was off to the races. For the remainder of that day, and in the four trading days that followed, the S&P 500 climbed mechanically, without interruption, to new all-time highs. This was a relentless surge of more than 50 points from the Friday morning low for the S&P 500 in just one week. Surely, there must have been some encouraging news in the days that followed April 5 to extinguish the fear that plagued markets for that fleeting five-minute period.

On Monday we learned that machine tool orders in the US declined 11.9% during the first two months of 2013 when compared to the first two months of 2012. There was nothing to celebrate in this report, but still the market worked its way higher.

On Tuesday the Commerce Department reported that wholesale inventories declined in February by the largest amount in 18 months, when the consensus had expected a gain of .5%. It also reduced its original estimate for January from an increase of 1.2% to just .8%. This was all the more shocking because it was the lack of inventory building that depressed economic growth in the fourth quarter of last year. The consensus was expecting a sharp bounce back, but it didn't happen. This is not good news for those expecting real economic growth of 3% in the first quarter. The disappointment didn't end there.

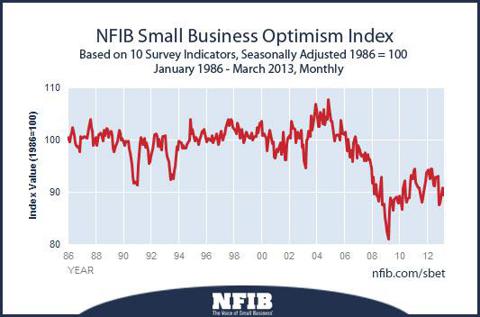

Also on Tuesday the National Federation of Independent Business (NFIB)reported that its index of small business optimism declined 1.3 points to 89.5, which was below the consensus expectation of no change. This index remains below the troughs it reached during the 1991-1992 and 2001-2002 recessions. The NFIB's chief economist, Bill Dunkelberg, states in the report-

"For the sector that produces half the private GDP and employs half the private sector workforce - the fact that they are not growing, not hiring, not borrowing and not expanding like they should be, is evidence enough that uncertainty is slowing the economy. Virtually no owners think the current period is a good time to expand, because they simply don't know what the future holds. So why invest?"

Regardless, the stock market continued to grind higher.

On Wednesday we received the minutes from the Fed's most recent policy-setting meeting, shortly after a few select banks and members of Congress received them. The minutes revealed that the majority of policymakers were leaning towards tapering off the asset purchase program (QE) by mid-year, before concluding the program by year-end. This should have been construed as a negative in the very short term, considering the lack of progress in the economy to date, but not last week. Commentators were temporarily baffled by the market's dismissal of the possibility that QE might end, until they reasoned that since these comments were made during a meeting that occurred prior to the horrible jobs number, QE would likely not be tapered off mid-year, or conclude at year-end, but instead continue. Therefore, this was a positive. I had to read the minutes and the commentary more than once in order to grasp this twisted logic. I was under what now appears to be the misguided impression that the purpose of QE was to improve the economic fundamentals, in job creation and economic growth, but now the consensus seems to prefer that the economy sputter, so that QE will continue indefinitely. This is reckless, drug-induced insanity. It is like a heavily medicated patient that wants to remain bed-ridden so that the steady dosage of morphine that has now become an addiction will continue. Of course, the S&P 500 surged to new all-time highs.

On Thursday we learned that US chain-store sales rose 1.6% in March on a year-over-year basis, below expectations of 1.8%, and down from the 2.9% increase one year ago. This disappointment came despite the benefit of Easter falling on March 31 this year, as opposed to April 8 last year. The stock market looked the other way, once again, with the S&P 500 climbing to new highs.

A double barrel of discouraging economic data points came yesterday with an unexpected decline in retail sales for March, the second decline in the past three months, and the University of Michigan's consumer-confidence gauge falling to a nine-month low. Headline retail sales fell .4%, while the core figure that excludes autos, gasoline and building materials fell .2%. It is the core figure that aligns most closely with the rate of growth in consumer spending used to calculate GDP. Core retail sales were also revised lower for January and February. These reports for retail sales and consumer confidence were well below consensus expectations. They also make it very unlikely, once again, that Wall Street strategists' recently upward-revised estimates for first-quarter real GDP to 3% will materialize.

During five consecutive days of dismal economic news, the stock market muscled its way higher. The fundamentals really don't seem to matter anymore. As I write this article, the modest selling pressure that ensued at the open today, not seen since last Friday's open, is once again giving way to a steady grind higher. Watching stock prices move up against the current of deteriorating economic fundamentals is what we see at the early stages of an economic recovery, as we did in 2009, when the market was serving as a discounting mechanism for good things to come. We do not see this type of activity at the latter stages of an expansion, and certainly not when the fundamentals are deteriorating, at least until now. This is clearly the byproduct of quantitative easing (QE). Some investors might be comforted by this type of price action, but I am not. It is not that I don't want to see the stock market appreciate, but rather that I want to see it appreciate on a foundation of strengthening economic fundamentals. Instead, the fundamentals are deteriorating. Therefore, I am concerned that we are in store for a third chapter of this boom-bust cycle that only those who were trading and investing during the last two, in the 1990s and 2000s, can appreciate. The booms take different shapes and are fueled in different ways, but all share the characteristics of loose credit, leverage and speculation. Adding additional risk to the current dislocation between the market and the economy is the broken structure of our financial markets--something that I was promised would be addressed by President Obama in 2009.

I have been watching the stock market trade, day-in and day-out, for more than 20 years. When you stare at a screen for that long and that often, you can tell when something is amiss. I don't know what or whose invisible hand is involved in these markets, but there is one, and a very big one at that. I'm sure that other traders and frequent investors will agree. It is hard to dismiss the sharp moves that occur in the benchmark indices within seconds, or the oddly timed inflection points that are defined at exactly 10:30am or 3:00pm every day, regardless of the news flow. It is exhausting to place limit orders for securities that show a sizable bid or ask, which miraculously vanishes the second you hit the send button. There is clearly something very different now in how the markets operate, and it is getting worse with each passing month, quarter and year. I know that the contributing factors are high-frequency trading (HFT), the influence of S&P futures on the cash market and the gradual decline in liquidity we have seen on the for-profit exchanges. In my view the individual investor, as well as many institutional investors, have been completely marginalized. It is no longer the public's market. The significance of this phenomenon is that I believe it has fed the latter stages of this bull market run in the same way no-doc loans and securitization fed the appreciation in the housing stock-unscrupulously. I plan to write a great deal more about this phenomenon in the months to come as I do more research.

What is fueling the steady surge in stock prices, as we saw this past week? It is certainly not the great rotation out of bonds and into stocks. The fund flows into domestic equity mutual funds, after having turned positive in January and February, slowed to a trickle before turning negative again in March, according to ICI data. The percentage of bulls in the American Association of Individual Investors (AAII) survey fell to a low of just 19.3% last week, which is a level not seen since the bear market low reading of 18.9% on March 3, 2009. What is going on? It seems pretty clear that the public is investing as Peter Lynch so famously used to, living in the real world, while Wall Street and Washington are living in a virtual one. The virtual world is clearly contrived by QE. When will these worlds collide?

Tom Lee, JP Morgan's chief market strategist, stated on Friday that he is bullish again, despite the weakening economic data, because the stock market has just "looked through" it. This is an awfully simple-minded statement coming from a chief market strategist, proving how dislocated he, along with the stock market, is from the real economy. Does this mean that Mr. Lee would have been bearish in early 2009, despite the early indications of improving economic fundamentals, because stock prices were still declining, or in other words, looking through it?

Chairman Bernanke is clearly living in the virtual world, myopically focused on the financial markets and operating under the illusion that the rubber his quantitative easing provides will soon hit the road to economic growth and job creation, but his theory has now proven to be based on a false premise. The wealth effect he is instigating is having no affect on wages and without an increase in wages, the wealth effect withers rapidly. Financial market wealth does not lead to an increase in the production of goods and services or a rise in incomes, especially when wealth is as concentrated in the US as it is today. It is a byproduct of an increase in the production of goods and services-or economic growth, as is a rise in incomes. Therefore, in my opinion, Chairman Bernanke is blowing bubble number three, and if we continue to see more weeks of economic distress as we did last week, that bubble will either burst or slowly deflate.

I am not forecasting a repeat of the financial crisis, although it wouldn't surprise me to see it happen. Nothing has changed since 2009 to prevent one from happening again. I have been forecasting continued anemic growth with the high probability of a consumer-led recession, similar to what occurred in the 2001-2 timeframe. I can't be bullish on the overall stock market in this environment, unless my investment thesis is simply to follow the speculative investment flow that is fueled by QE. This isn't an investment strategy, but a game of musical chairs, for when the consensus concludes that the QE fuel tank is nearing empty, there will undoubtedly be abrupt and very negative consequences for financial assets. The alternative is that QE continues indefinitely, because the Fed fears the consequences for financial assets should the program end. The deterioration in economic fundamentals then will become so overwhelming that even the few living and benefiting from this virtual world can no longer deny the reality on the ground.

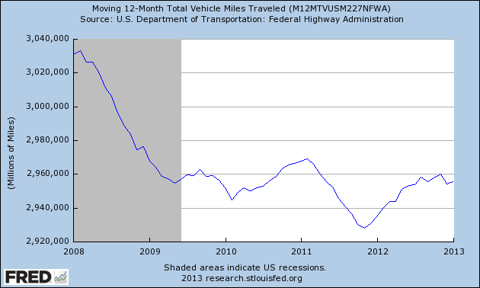

They say that a picture is worth a thousand words--especially one that isn't polluted with seasonal adjustments and quarterly or annual revisions. I think the picture below best exemplifies both the strength of the US economy today and the effectiveness of fiscal and monetary policy stimulus on economic growth and job creation. It's a simple chart of the number of miles driven in the US. It has stagnated for four years. I would love to see all those bullish Wall Street strategists and economic pundits that see accelerating rates of growth on the horizon explain the chart below.

Additional disclosure: Lawrence Fuller is the Managing Director of Fuller Asset Management, a Registered Investment Adviser. This post is for informational purposes only. There are risks involved with investing including loss of principal. Clients of Fuller Asset Management may hold positions in the securities mentioned in this article. Lawrence Fuller makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by him or Fuller Asset Management. There is no guarantee that the goals of the strategies discussed by will be met. Information or opinions expressed may change without notice, and should not be considered recommendations to buy or sell any particular security.